Transparency and Planning: How To Set Clear Expectations and Win Over Clients

In the competitive world of financial planning, establishing trust with potential clients is crucial for building a successful and lasting relationship. This article explores how transparency and planning can be powerful tools in setting clear expectations, fostering trust, and ultimately winning over clients. It provides actionable strategies to optimize your financial planning process, improve communication, and demonstrate the value you bring to the table. By prioritizing transparency and effective planning, you can empower your clients and create a solid foundation for long-term success.

Uncovering the Root Causes of Challenges in Financial Advisory Firms with the Five Whys Technique

Financial Planning firms often face recurring challenges that hinder growth and client satisfaction. The Five Whys technique, a powerful problem-solving method, can help address these issues by identifying their root causes. By asking "why" five times, financial advisory firms can develop targeted action plans, improve communication, and foster a culture of continuous improvement. In this article, we'll explore how the Five Whys technique can be applied to tackle common problems and drive lasting success in the financial advisory industry.

Three Key Strategies for Improving Efficiency in Financial Planning Operations

In today's fast-paced and ever-evolving financial planning industry, optimizing processes, eliminating waste, and fostering a culture of continuous improvement are essential for achieving success and staying competitive. By following the three key strategies outlined in this article - process mapping, waste elimination, and fostering a culture of continuous improvement - financial planning firms can streamline operations and prepare for successful automation implementation.

Capture Attention and Build Trust: The Power of a Bio Video for Financial Advisors

Are you a financial advisor looking to create a powerful bio video that captures the attention of your target audience and showcases your unique value proposition? Look no further! This comprehensive guide will walk you through the entire process, from defining your brand and target audience to producing and optimizing your final video. You'll learn practical tips and strategies for writing a compelling script, choosing the right setting and visual elements, and delivering a confident and engaging performance on camera. With this guide, you'll have everything you need to create a bio video that effectively communicates your expertise, builds trust with your audience, and helps you achieve your business goals.

Transform Your Business with Email Funnels: A Financial Advisor's Guide

Discover how financial advisors can use email funnels to boost their business and attract new clients. Learn strategies for creating engaging email campaigns, optimizing content, leveraging email marketing best practices, and building strong client relationships. Improve your financial advisory business with this essential guide on email funnels, client relationships, and business growth.

Mastering YouTube: The Key to Building Your Financial Advisory Brand

YouTube is the perfect platform for financial advisors to build their brand and connect with clients. By providing valuable advice and engaging video content, you can maximize your reach and grow your business. In this post, we'll explain the significance of having a YouTube presence and the benefits of creating a successful channel for your advisory business.

How Did I Get Here?

“It’s easy to overlook all of your growth and progress in the moment. We all need to take a bit more time to feel proud of ourselves.” ~Salil Bloom

To effectively reflect on the past and future, mentally transport yourself to those times from your present perspective. Professional authors Benjamin Hardy and Dan Sullivan offer a useful framework in their book, "The Gap and The Gain: The High Achievers' Guide to Happiness, Confidence, and Success," which highlights the importance of considering both the gap between where you are and where you want to be, and the gain between where you were and where you are. When reflecting on the past, it's easy to overlook growth and progress that have been made. Take the time to celebrate your accomplishments and feel proud of yourself. Also, consider how your definition of success has evolved over time.

Salil's questions on time travel really made me think. To break down my thoughts, I'll answer them in a Q&A format. Let's dive in...

Financial Advisor Fees with Transparency and Clarity: A Better Way to Communicate Value

The world of financial planning can be overwhelming, especially when it comes to understanding fees and how planners are compensated. Advisors often use industry jargon that may leave consumers confused. Terms such as fee-only, fee-based, flat fee, retainer, subscription-based, percent of AUM (what is AUM?), CFP® credentials, and fiduciary are just a few examples. But what does this really mean for the consumer? How are you being compensated, and what is involved in those fees? Here are some tips for breaking down your fee structure in plain language.

4 Tips for Utilizing Your CRM With Consistency

When your CRM is not being used to its fullest potential, it can lead to confusion within your team on roles and responsibilities, tasks slipping through the cracks, frustrated clients, and an overall stressful work environment. To avoid these messy situations, try the following four tips for consistent and effective CRM utilization: Data Quality, Establishing a CRM Framework, Adequate Training for Your Team, Effective Habits and Regular Reviews.

Financial Planning: Tailoring Your Message To Your Ideal Client

Many financial advisors discuss the basics of financial planning, which is a great starting point for those unfamiliar with the concept. However, focusing solely on high-level strategies and opportunities will only resonate with a broad audience and not specifically with your ideal client. It's essential to tailor your message to ensure it speaks directly to your target audience.

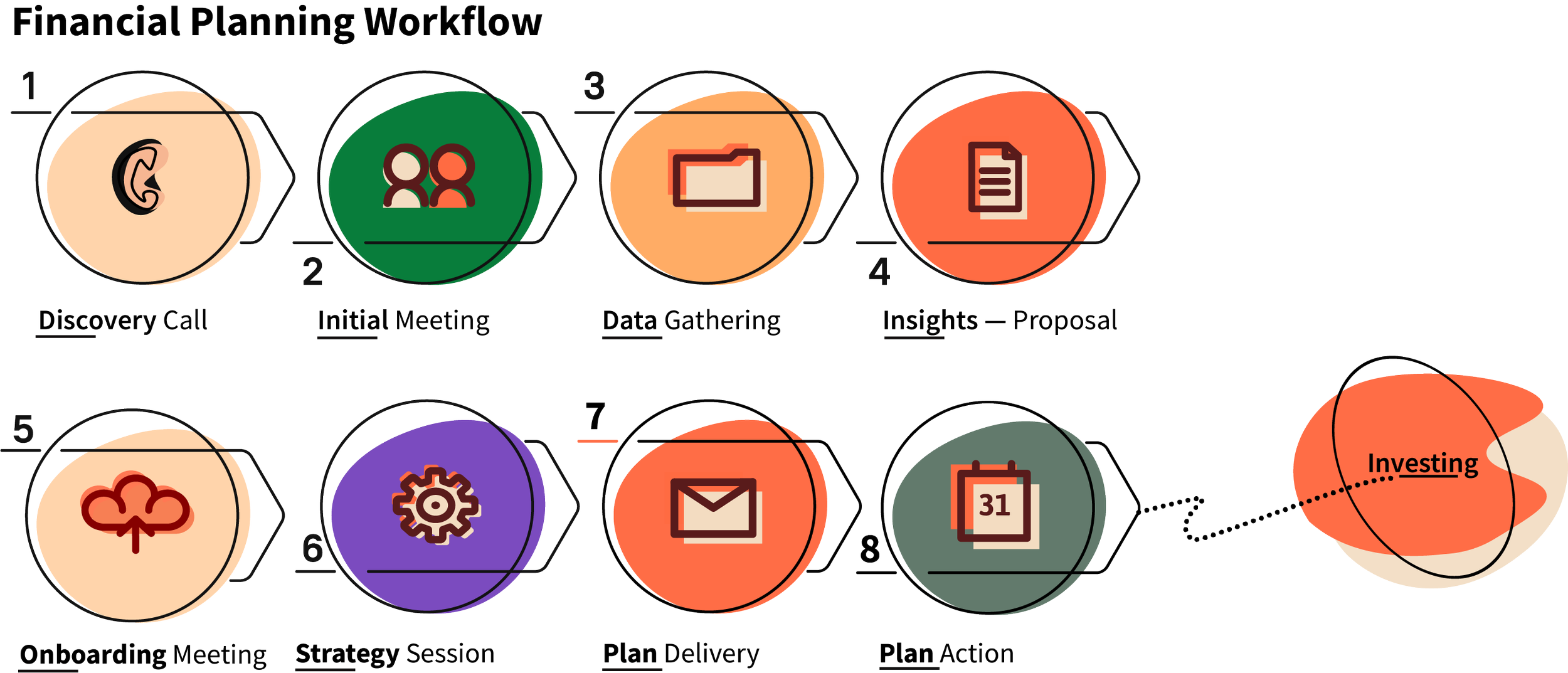

Laying the Foundation: How to Structure Your Financial Planning Process

Financial planning can vary greatly from person to person or company to company. Regardless of your approach, it’s crucial to define the primary steps and start with a high-level workflow. This is the first course of action in outlining your process. To get started, consider the following: What does your ideal process entail? What is the timing for each step? What outcome do you want to achieve? What tasks are involved in each step? Who is responsible for each task? What resources can you develop to support your process and team?

5 Critical Website Audit Questions To Ask Yourself

The internet is full of outdated and ineffective websites that fail to engage users or generate conversions. Is your website one of them? Ask yourself these 5 questions along with my 6-step web audit process will help you identify areas for improvement and create a plan for making your website more effective and impactful. With fresh copy and design, you can transform your website into a powerful marketing tool that attracts and converts visitors.

Financial Planners: Maximizing Your Business Potential With Core Meetings

Meetings can be overwhelming and time-consuming, but they are critical to achieving your goals. By putting in the time upfront, these core meetings will simplify the rest of your work and make it easier for the whole team to understand their roles, responsibilities and next steps. Weekly stand-up meetings should be relatively short and concise, presenting a quick and thorough insight to the team. The pattern I've outlined will keep your business engaged, connected, and moving forward. Spacing them out throughout the week will not only ensure visibility but also keep you and your team engaged with each other.

5 Tips For Facilitating Great Meetings

It can be hard sometimes as the facilitator to keep the meeting on track and make sure that everyone is participating. There are 5 things you can do as a facilitator to make your meetings more productive and inclusive: be comfortable with silence, ask open-ended questions, focus on learning and not complaining, create a good balance between listening and doing, and manage the team’s energy.

How To Get The Most Out Of Your Meetings

The issue of unnecessary feedback from team members can be frustrating and unproductive, leading to disengagement. To address this issue, it is helpful to have a structured meeting with a preset agenda. Providing guidelines for an effective agenda and creating a positive atmosphere can encourage team ownership during meetings.

Learning From Your Industry Competitors

You can learn a lot from your competitors! You can analyze their marketing strategies and see what works well for them. You can look at their product or service offerings and see how you can improve your own offerings. You could analyze their pricing structure and see where you could be more competitive. Most importantly, you can learn what to avoid.