Financial Advisor Fees with Transparency and Clarity: A Better Way to Communicate Value

The world of financial planning can be overwhelming, especially when it comes to understanding fees and how planners are compensated. Advisors often use industry jargon that may leave consumers confused. Terms such as fee-only, fee-based, flat fee, retainer, subscription-based, percent of AUM (what is AUM?), CFP® credentials, and fiduciary are just a few examples. But what does this really mean for the consumer? How are you being compensated, and what is involved in those fees? Here are some tips for breaking down your fee structure in plain language.

Financial Planning: Tailoring Your Message To Your Ideal Client

Many financial advisors discuss the basics of financial planning, which is a great starting point for those unfamiliar with the concept. However, focusing solely on high-level strategies and opportunities will only resonate with a broad audience and not specifically with your ideal client. It's essential to tailor your message to ensure it speaks directly to your target audience.

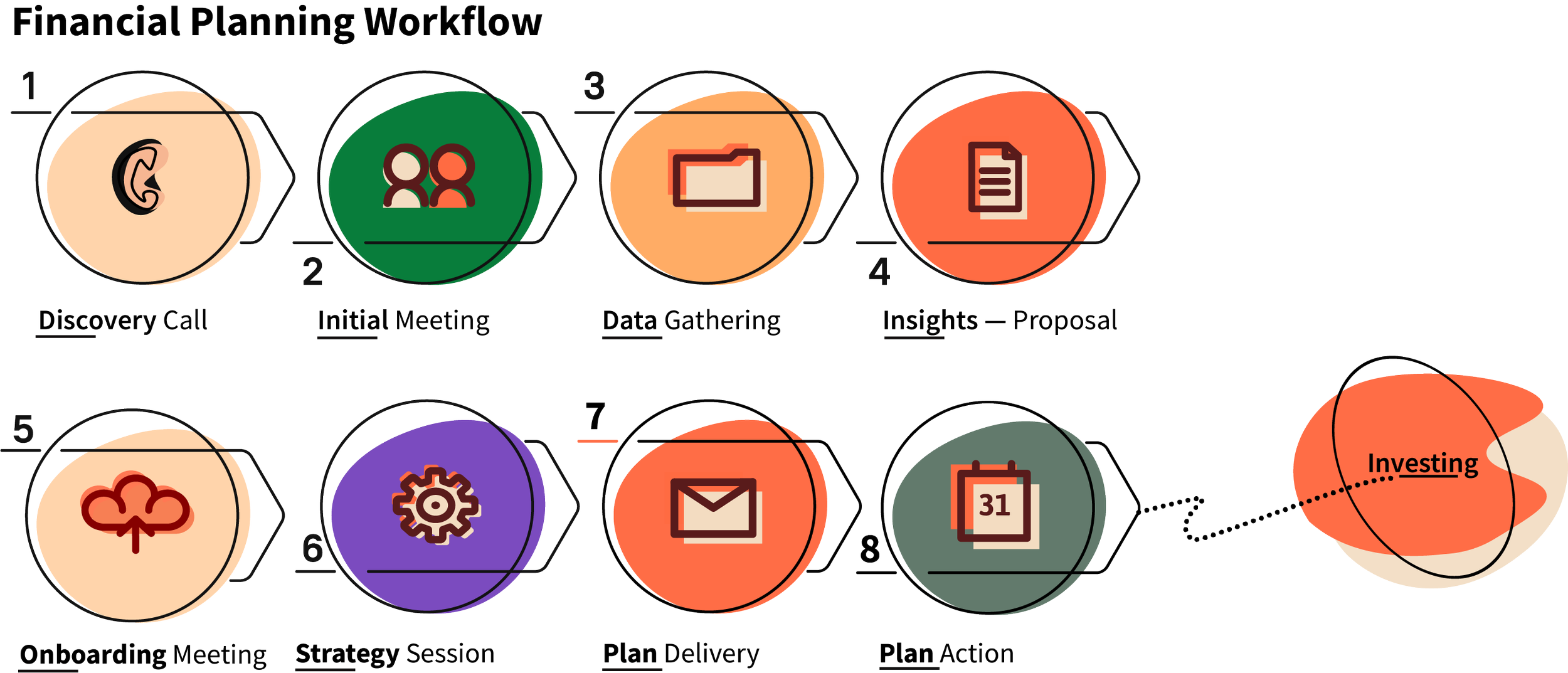

Laying the Foundation: How to Structure Your Financial Planning Process

Financial planning can vary greatly from person to person or company to company. Regardless of your approach, it’s crucial to define the primary steps and start with a high-level workflow. This is the first course of action in outlining your process. To get started, consider the following: What does your ideal process entail? What is the timing for each step? What outcome do you want to achieve? What tasks are involved in each step? Who is responsible for each task? What resources can you develop to support your process and team?